30+ Line of credit loan calculator

The impact that making up to four new draws against your line of credit of varying amounts and on a irregular schedule will have on repaying the loan. Home Equity Line of Credit.

Net 30 And Other Invoice Payment Terms Invoiceberry Blog

Earn unlimited 2X miles on every purchase every day.

. Let Bankrate a leader. On a 50000 line of credit the business may only use a portion of the available funds and if that is repaid in full the business can then have access to the full. Before you ask for a Credit One Bank credit line increase you should make sure that your credit score is in good standing.

Line of credit calculator. Calculate your mortgage payment. The rates shown are averages based on thousands of financial lenders conducted daily by Informa Research Services Inc.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Fixed-Rate Loan Option at account opening. All home equity calculators.

Line of credit calculator. Assumes your current credit card interest rate is 20 your loan interest rate is 10 and your credit line interest rate is 10. Bankrates experts compare hundreds of top credit cards and credit card offers to select the best in cash back rewards travel business 0 APR balance transfer and more.

One now needs to multiply every purchase amount by the number of days remaining in. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within. Here we provide calculator to calculate interest payment amount on line of credit loan with the examples.

It can also display one additional line based on any value you wish to enter. For example if your lender will allow a 95 ratio the calculator can draw that line for you in addition to the other three. Using the Line of Credit Payoff Calculator.

10-30 years of fixed payments. To calculate your approximate savings the 000 interest rate that you entered on the input screen was applied to the. To use the loan payoff calculator youll start by entering two critical pieces of information.

The personal loan calculator will give you an approximate guide to what someone with a particular credit rating will get. The minimum HELOC amount that can be converted at account opening into a Fixed-Rate Loan Option is 5000 and the maximum amount. Line of credit calculator.

All home equity calculators. Home equity loans are similar to personal loans in that the lender issues you a lump sum payment and you repay the loan in fixed monthly installments. The effect that new monthly charges on your line of credit will have on repaying the loan.

Actual results and loan or line of credit payment amounts and repayment schedules may vary. The remaining l oan balance and the APR interest rate youll be paying. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

The Annual Percentage Rate APR is variable and is based upon an index plus a margin. Line of credit calculator. Then as the COVID-19 crisis struck interest rates crashed to the floor shifting homeowner.

Using Bankrates student loan calculator can help you create a student loan repayment strategy thats right for you. Creditor Insurance for CIBC Personal Lines of Credit underwritten by The Canada Life Assurance Company Canada Life can help pay off or reduce your balance in the event of death or cover payments in. The 30-year fixed home mortgage APRs Points a Single Family - Owner Occupied Property Type and an 80 60-80 Loan-to-Value Ratio.

A 30-year fixed mortgage is a mortgage that has a specific fixed rate of interest that does not change for 30 years. Mortgage loan basics Basic concepts and legal regulation. From there youll have the option to calculate by monthly payment or c alculate by payoff time.

A home equity line of credit or HELOC is a type of home equity loan that works like a credit card. Line of credit calculator. List all the purchases made during the billing cycle.

All home equity calculators. You may convert a withdrawal from your home equity line of credit HELOC account into a Fixed-Rate Loan Option resulting in fixed monthly payments at a fixed interest rate. The calculator is fairly straightforward.

Calculator assumes a constant rate of interest. As the Federal Reserve has lifted short-term interest rates in the late 2010s many homeowners who typically opted for the cash-out refi option in the prior decade became more inclined to use a home equity loan or line so they keep their existing low rate on the majority of their home debt. However when you apply for a loan this will be based entirely on your particular circumstances personal credit rating and the criteria of the loan provider so may vary a little from the rough guide the calculator.

Line of credit Repayment terms. Debt consolidation calculator. Youre given a line of credit thats available for a set time frame usually up to 10 years.

You may convert a withdrawal from your home equity line of credit HELOC account into a Fixed-Rate Loan Option resulting in fixed monthly payments at a fixed interest rate. The APR will vary with Prime Rate the index as published in the Wall Street Journal. A HELOC operates similar to a credit card in.

Calculate your mortgage payment. If you choose a 30-year fixed mortgage your monthly payment will be the same every month for 30. How much house can you afford.

Owners of small businesses may want to consider a line of credit over a business loan as well because access to credit may serve the business owners needs to a greater degree. Fixed-Rate Loan Option at account opening. Fortunately there are plenty of ways to check your credit score online.

The minimum HELOC amount that can be converted at account opening into a Fixed-Rate Loan Option is 5000 and the maximum amount. Enjoy a one-time bonus of 75000 miles once you spend 4000 on purchases within 3 months from account opening equal to 750 in travel. All home equity calculators.

Guide to Line of Credit Calculator. To get the number of payments for your loan. For example a 30-year fixed mortgage would have 360 payments 30x12360.

Click the bubble next to the one you want to tinker with first. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100. 30-year fixed mortgages are the most popular mortgage product nowadays and are especially popular among first-time home buyers.

How the Loan Payoff Calculator Works. Which is usually a month and that would be 30 days.

Pin On Ui Ux Gallery

You Want To Be Able To Withdraw 20 000 Each Year For 30 Years Your Account Earns 10 Interest How Much Do You Need In Your Account At The Beginning Quora

30 Bullet Journal Budget Tracker Printable Options 2022

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Payroll Checks

Pin On Dashboard

Online Loan Amortization Schedule Printable Home Auto Loan Repayment Chart Online Loans Amortization Schedule Payday Loans

How To Get Out Of Debt Fast The Science Backed Way Student Loans Refinance Student Loans Loan

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Microsoft Word Templates Templates

4 Bonus Structure Templates Free Sample Templates How To Plan Bonus Templates

Debt Stacking Excel Spreadsheet Debt Snowball Calculator Debt Reduction Debt Snowball

Event Budget Template Event Budget Template Event Budget Budget Spreadsheet

30 Free Payment Methods Credit Card Iconsets Icon Set Business Icon Buy Icon

30 Questionnaire Templates And Designs In Microsoft Word Inside Business Requirements Questionnaire Tem Questionnaire Template Questionnaire Business Template

What Are Net 30 Payment Terms And Why Are They Useful Gocardless

Walmart Pay Stub Template Samples Of Paystubs Nurul Amal In 2022 Payroll Template Statement Template Professional Templates

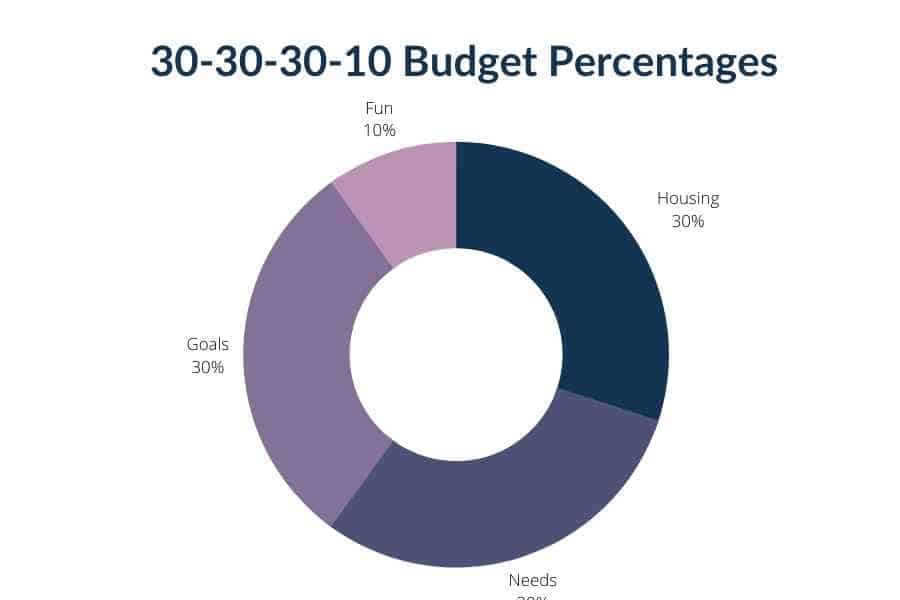

30 30 30 10 Budget Explained Pay Your Bills And Still Have Fun Boss Single Mama

Are You Looking For Step By Step Instructions On How To Create A Budget When You Are Behind On Bills Here The Steps Budgeting Money Management Budget Planning